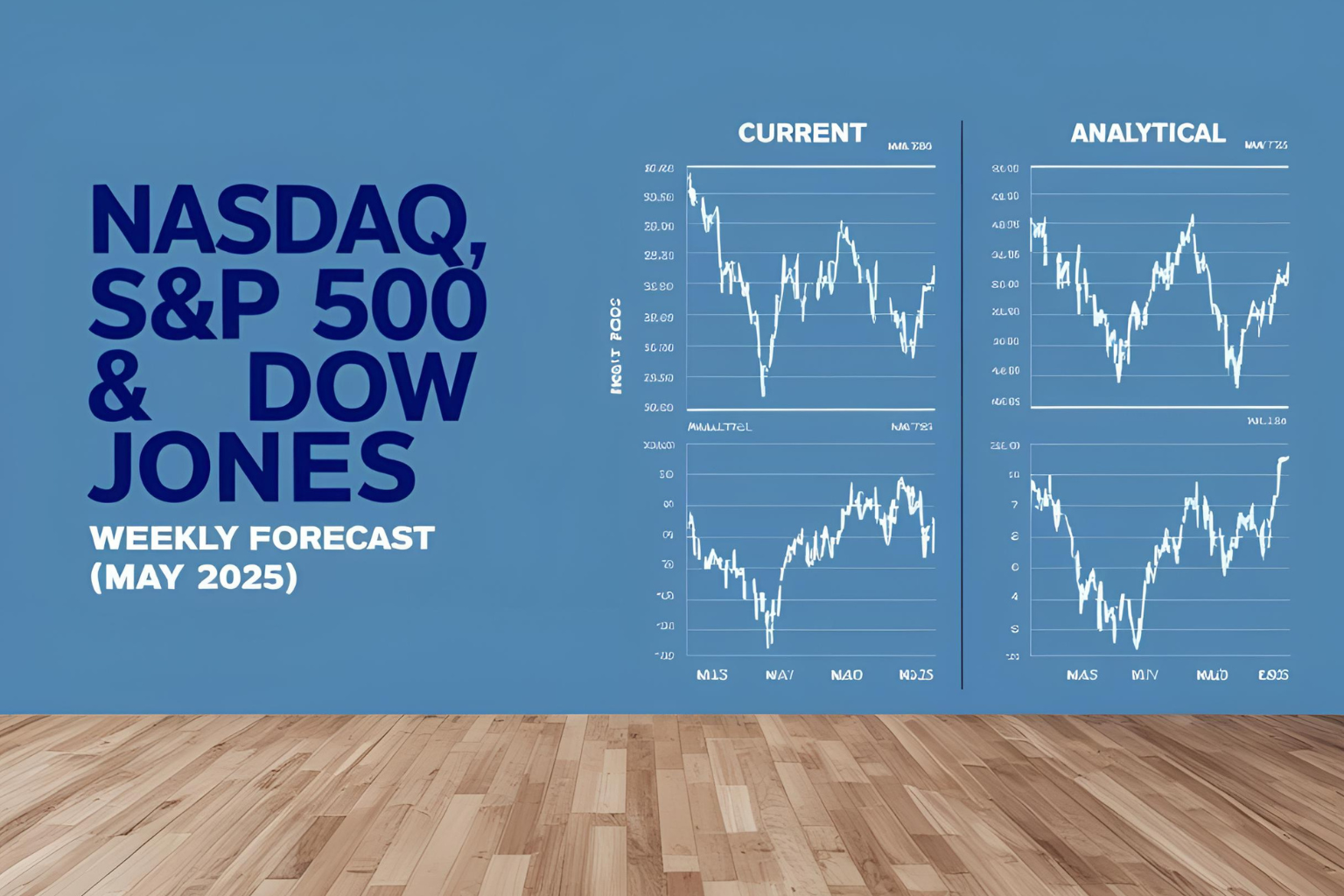

Nasdaq, S&P 500 & Dow Jones Weekly Forecast (May 2025)

Introduction

As we enter a new trading week in May 2025, market participants are watching key indices like the Nasdaq 100, S&P 500, and Dow Jones Industrial Average (DJIA) for signs of momentum, reversal, or consolidation. This weekly forecast breaks down the technical levels, economic events, and market sentiment that could influence price action.

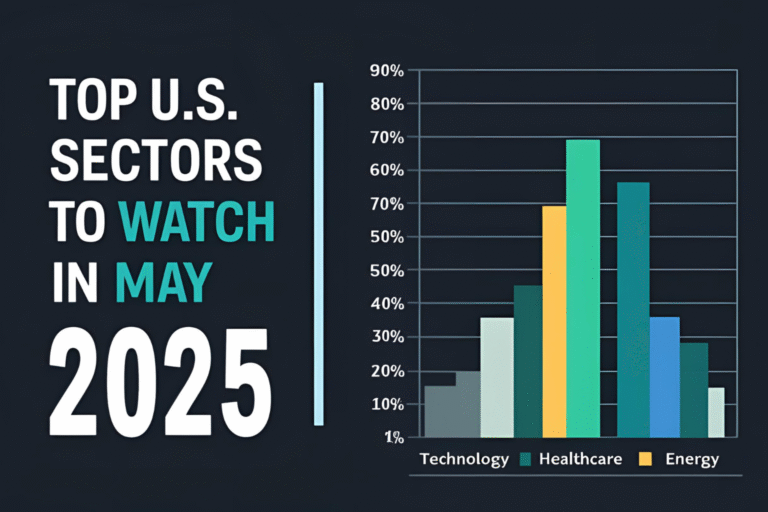

1. Nasdaq 100 Outlook

The Nasdaq remains in a bullish uptrend, buoyed by strong tech earnings and improving economic sentiment.

Key Support: 17,850

Key Resistance: 18,300

Watch for potential breakouts above 18,300, especially if inflation data comes in below expectations. Tech leadership from AI and semiconductor stocks is a major driver.

2. S&P 500 Forecast

The S&P 500 is testing its 4,950 resistance level after rebounding from recent consolidation.

Key Support: 4,875

Key Resistance: 4,950

This week’s CPI report and Fed commentary will heavily influence directional bias. Bulls need a close above 4,950 for sustained upside.

3. Dow Jones Industrial Average (DJIA)

The Dow lags slightly behind due to weakness in industrial and financial stocks.

Key Support: 38,000

Key Resistance: 38,600

Look for rotation plays. If the Dow breaks above 38,600, we may see catch-up momentum. Otherwise, a choppy sideways movement is likely.

4. Economic Events to Watch This Week

- CPI Inflation Report – May 14

- Initial Jobless Claims – May 16

- Fed Officials’ Speeches – Ongoing

These data points could significantly shift short-term market expectations and affect index volatility.

5. Sentiment & Volatility Overview

- VIX: Hovering around 13, indicating relatively low fear

- Put/Call Ratio: Neutral at 0.91

- Market Breadth: Improving, with more stocks above 50-day moving averages

Institutional flow still leans bullish, but traders should remain cautious around key macro events.

Conclusion

The U.S. equity markets are entering a critical week with the potential for breakouts across all three major indices. Stay focused on macro data, earnings guidance, and sector rotation for trading opportunities.

FAQs

What is the outlook for Nasdaq this week?

The Nasdaq shows bullish potential with resistance near 18,300; watch tech stocks and CPI data closely.

Is the S&P 500 likely to break new highs?

A close above 4,950 could lead to a new breakout if economic data remains favorable.

Why is the Dow lagging?

Underperformance in industrial and financial sectors has slowed Dow’s progress compared to tech-heavy indexes.

What events can move the market this week?

The CPI inflation report and Fed speeches are major drivers of index volatility this week.

How should I trade this week’s market forecast?

Focus on breakout setups in Nasdaq, range plays in Dow, and CPI-driven volatility across all indices.